Automations service allows you to quickly respond to important events while avoiding inefficient manual work and human errors. Use the service to automate customer communications, platform maintenance, as well as account, trades and trading settings management.

- Your platform administrator got distracted and rebooted the main trade server in the middle of a trading week instead of restarting an access point?

- Your manager mistakenly wrote off the funds from the client's account instead of adding a bonus?

- Forgot to send the "Create a real account" offering to potential customers losing some of traders?

- Failed to adjust account group and trading instrument parameters during a market crash?

- Failed to promptly activate backup access points during a DDoS attack causing your trade server to become unavailable to traders?

Protect yourself from such errors and avoid losses using our service. With Automations, you get a whole department of employees who never forget anything, do everything on time and adhere to instructions at all times.

Why does your business need Automations?

-

Employee efficiency

Routine operations take away the time of your employees. The more time your managers spend on mailings and managing trading activity, the fewer calls they make. Entrust the routine to algorithms and direct free resources to strategically important areas.

-

No errors

Any employee can miss something, forget about an important task, get sick or distracted. Automations fully insures your business against such situations.

-

Safety margin

Automations is able to handle both one and one thousand operations with the same speed. This means unlimited scaling opportunities for your business - you can easily cope with the increased workload without increasing the number of employees.

-

More profit

Inaccuracies and errors often bring losses - both indirect and direct ones. Reduce losses and increase conversions with instant and error-free response to dangerous situations.

How it works

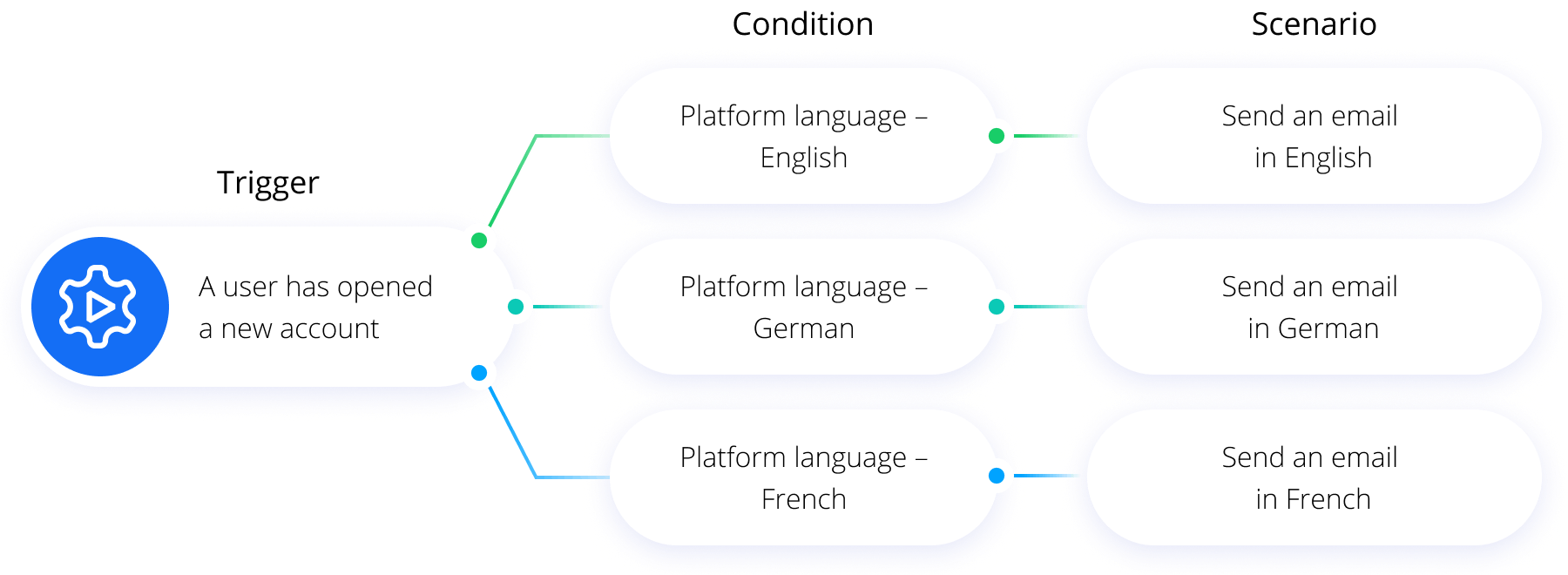

A certain event occurs in the trading platform you should respond to. This event is called a trigger. You can create as many triggers as you like refining them with additional conditions. When a trigger is activated, Automations will run the specific scenario you have selected. Currently, we offer more than a hundred ready-made scenarios that we have created according to the most popular customer requests. However, if you have a unique request, you can create new scenarios yourself.

An example of a standard scenario: welcome letters to new customers in different languages. When a user opens a new account, a trigger is activated in the system. The condition checks the user's platform language and sends the appropriate email.

What operations do Trade Master 9 users usually automate?

-

Communication with clients

Send push notifications, SMS, emails or internal messages in response to trading account events. Assist new clients in proceeding to registration or to real trading. Automatic mailings improve user onboarding, facilitate real account opening and encourage trading activity. The balance has decreased? Offer replenishment. There have been no trades for a long time? Advise to subscribe to forecasts or signals. The account has been topped up? Add a bonus. Respond to changes in trader activity instantly to increase Life Time Value, as well as convert more demo account to real ones.

-

Platform maintenance

Automatically restart data feeds, gateways and servers on schedule, or when CPU, memory or hard drive load changes. You can additionally set up automated synchronization of history servers. You no longer need to spend resources on manual monitoring and constantly track critical areas to keep the trading platform up and running 24/7 - as soon as important parameters deviate from the norm, you will instantly receive an automatic notification and be able to respond to the situation.

-

Managing platform settings

Automation is indispensable in case of sharp market movements — it enables quick and smooth adjustment of trading parameters. Automatically adjust account group parameters to changing market activity metrics. For example, reduce the number of available financial instruments or simultaneously open positions, charge additional commissions and change Margin Call and Stop Out levels. If the instrument volatility increases according to the scenario, change its parameters: move the Stop Loss and Take Profit levels apart, adjust the minimum and maximum trade volumes, change the trading session and margin calculation parameters. You can also automatically adjust trade request routing rules.

-

Trade management

Set up forced position or trade closing when the price reaches certain predefined levels. The scenario can be applied both to individual accounts and to account groups. This can come in handy when closing all traders' positions upon futures contract expiration.

-

Account management

Configure notifications about suspicious user activity in order to monitor and prevent issues in a timely manner. Create a bonus program for loyal customers in a couple of clicks. Use scenarios to stand out from the competition, build loyalty among your clients and protect yourself from toxic traders.