Trade Master 9 for hedge funds

All markets in one place

Create a multi-asset infrastructure on a single platform in a couple of days. You no longer need separate terminals with disparate analytics. Work in different markets, customize necessary tools, try various strategies — use a single exchange terminal with the integrated risk management and analytics.

Over 80 exchanges and liquidity providers

Receive access to over 80 exchanges around the world. Trade Master 9 is directly linked to global financial exchanges and popular liquidity providers. Our gateways are easy to manage: control and re-structure your business, manage risks, generate reports, receive quotes and withdraw money.

Accessible algorithmic trading

Powerful algorithmic trading features: create, customize and test your own trading robots or use the ready-made ones. All components are combined into a specialized TM9 IDE supporting Python, R and other languages.

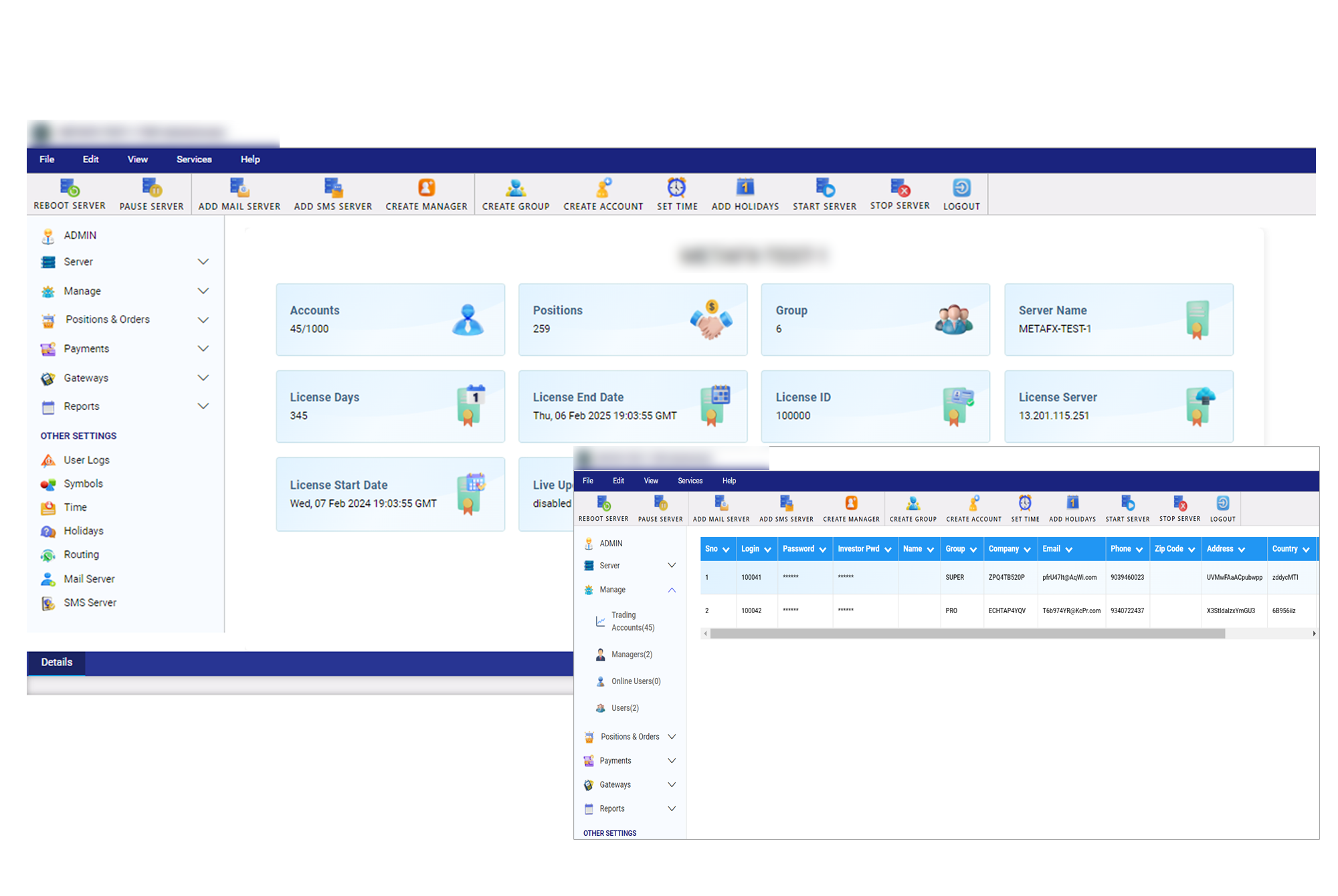

Full automation and flexibility

Automate your work flow: set up separate access for your employees and investors, monitor the work of your team members, generate performance reports, adjust payouts based on rates, commissions, payment methods and other conditions. Set individual properties for each fund: requirements for investors, financial instruments, settlement methods, capitalization, share values, etc.

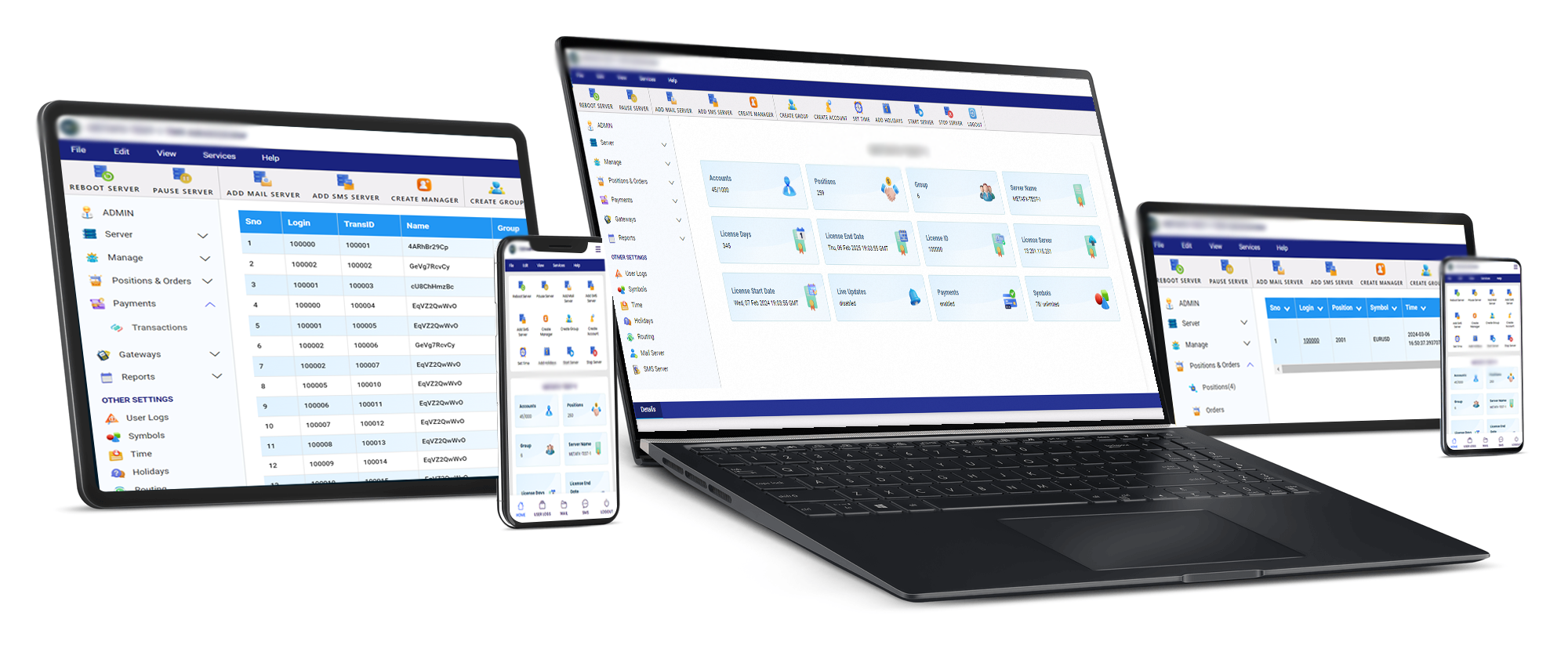

Maximum mobility

Fund members are able to work with Trade Master 9 via PC or mobile devices . This is convenient for your employees since they will be able to manage assets while they are stuck in a traffic jam, as well as for investors, who will be able to monitor the fund performance and apply for an investment at any time.

Benefits for a hedge fund

You also get

- Free installation and training

- Technical support: online chat, service desk, hotline, documentation, FAQ, articles and other useful materials

- Access to back-office APIs: ready-made documentation with examples and consulting

- Auto update